The US central bank's real-time payment system ‘FedNow Service’

Is in full operation, explaining the difference from CBDC

[SNS 타임즈- LA] The central bank of the United States (FED) announced on the 20th that the new instant payment system "FedNow Service (FedNow)" has started operation.

Banks and credit unions of all sizes are now registered to use FedNow to send money to their customers. FedNow claims to be able to send money 24 hours a day, 365 days a year.

It was previously announced that FedNow would go live around this time. In August last year, it announced that it would start full-scale service from May to July 2023.

The FED has posted a "FAQ" on its official website about FedNow. Among them is the question: "Is this service an alternative to cash? Is it a Central Bank Digital Currency (CBDC)?"

He answered 'no' to this question and explained that 'FedNow is a payment service for financial institutions to send money for their customers and has nothing to do with digital currency.' He said it was neither a form of currency nor a step toward eliminating other forms of payment such as cash.

And CBDC is described as follows.

The Fed has not decided to issue a CBDC. Issuance shall proceed only by law.

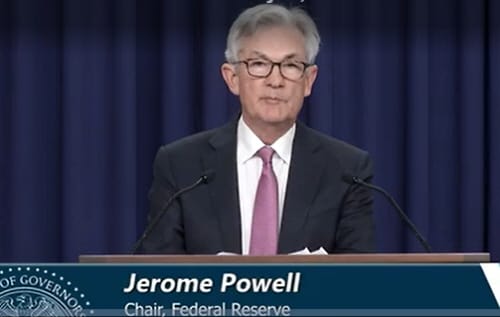

Regarding the benefits of FedNow, Federal Reserve Chairman Jerome Powell said in today's announcement:

Over the next few years, we built FedNow to make payments faster and more convenient for everyone. As more banks use FedNow, individuals and businesses can benefit.

For example, individuals can receive their paychecks sooner, or businesses can have immediate access to the money they claim.

At the time of FedNow's launch, 35 financial institutions and 16 service providers will be FedNow-enabled. The Fed said that in a few years, customers should be able to send money safely and quickly through FedNow-enrolled financial institutions' mobile apps and websites.

So far, BNY Mellon, JPMorgan Chase, and Wells Fargo are FedNow-enabled.

by coinpost.jp

,

- Copyright, SNS 타임즈 www.snstimes.kr